Photo credit: Jim Edmonds

It’s been just over a month since my return from the Deep South Investors Tour sponsored by Faith and Money Network and Hope Credit Union. Since I got back, I’ve shared so much about the trip with so many people — it was simply that powerful, and there was so much to say about all the towns and neighborhoods we visited, as well as memorials, museums, and historic sites.

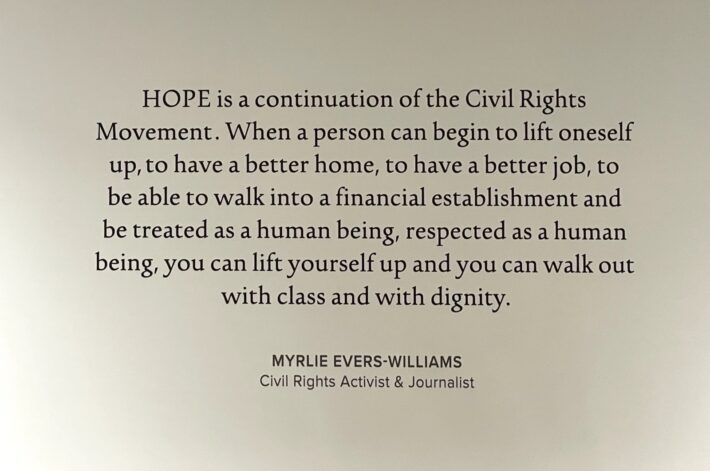

Right now, I want to share understanding and inspiration gained on the trip from the perspective of an investor. If I were to sum that up in one sentence, it would be, “The way things are in our banking systems isn’t the way things have to be.”

One place of inspiration is Hope’s work with individuals and families. Take the experience of a person from an under-banked community who is seeking a small consumer loan, perhaps for major car repair or a medical emergency. Often, such individuals are not deemed credit-worthy by the big banks using one-size-fits-all, pre-set algorithms.

At that point, families too often turn to a storefront lender, like a check-cashing store or payroll lending institution. Small amounts of money lent for short amounts of time don’t sound really bad, but the APR can be huge and have long-term devastating consequences.

But Hope Credit Union looks for alternative ways of evaluating credit worthiness. I was moved by the stories of Hope staff combing through a family’s history of paying bills and rent on time to raise the credit ratings enough to qualify for a loan at market rates.

Photo credit: Jim Edmonds

Another area of revelation for me was how access to capital can help transform small communities. When a community can dream of a strategy to meet its specific needs, and then has a financial institution that is willing and able provide the capital to make those dreams come true, transformation happens. In the Frayser neighborhood of Memphis, a largely-abandoned shopping center was transformed to a STEM academy for elementary and middle school students largely with funding available through Hope. A side benefit is that businesses nearby began to re-invest in their own properties, so that the entire neighborhood is revitalizing.

Hope Credit Union is also active in an innovative partnership with a purpose-driven architectural and construction firm to repair existing housing and create new affordable housing units in the Mississippi Delta area. In Woodlawn, Alabama, Hope helped with financing new housing construction, and later provided financial advice and resources for first-time homeowners who purchased these homes. Once again, the infusion of capital in a specific project had spill-over effects that uplifted the entire community.

Ultimately, banks and credit unions rely on the deposits of investors to create the capital accumulation that allows them to make loans to businesses and individuals. Often in our nation’s history, decisions about who gets this access to capital have worked against the creation of wealth for America’s black citizens and communities. It is a joy for me to be able to invest in a financial institution that changes the paradigm. Hope Credit Union is exemplifying a different way to think about capital investments. They model the truth that the way things usually are in our financial systems isn’t the way things have to be.

Jeanne Marcus | July 11, 2023

Jeanne Marcus has been part of the Church of the Saviour congregations for many years, and a long-time wrestler with the complex issues around money in our lives.