It started with an idea.

Create a class for seminary students about money. Not just a course on stewardship as a church campaign, but a conversation about stewardship as a way of life. A place where seminarians could examine their own relationship with money — without guilt, shame or inadequacy. A curriculum that could help them preach it to their congregants.

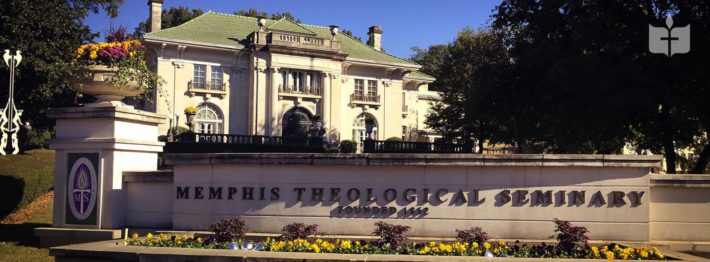

This spring, “Faith and Money: Making the Connection” came to life at Memphis Theological Seminary in Tennessee with 18 students, two on-campus course instructors and the support of Faith and Money Network.

Learning how to talk about money

The idea for the course emerged nearly two years earlier from a conversation held between Faith and Money Network director Mike Little and board member Jim Marsh Jr. Little and Marsh were wrapping up a daylong Faith and Money Network workshop for a group of pastors from North Carolina, when the pastors began to share that they never learned how to engage in conversations about money while in seminary. We wish we had been taught this, they said.

With that comment in mind, Little and Marsh began to create materials for a course that would equip potential pastors to not only talk about money, but also to examine their own personal relationship with it.

Once the idea was set, they reached out to Rev. Billy Vaughan, Co-Director of the Center for Faith and Imagination at Memphis Theological Seminary. After a day at the table planning, they finalized the course with Vaughan and Rev. Fekecia Gunn, Director of Enrollment Services at Memphis Theological Seminary, at the helm in the classroom.

Gunn said preparing future ministers for church administration and finance has been a priority for Memphis Theological Seminary since 2012. When she learned of the proposed Faith and Money Network class she said “everything just kind of clicked that we should partner.”

Faith and Money Network provided the syllabus with assigned texts and conversation topics. Guest speakers were organized by Faith and Money and shared via streaming video. But Vaughan and Gunn were responsible for facilitating the conversations in the classroom.

Vaughan said he and Gunn quickly decided that they didn’t want the course to be primarily lectures.

“We really wanted it to be their engagement,” he said.

On the first day of the course, Vaughan said he was surprised at how “hungry” the students were to discuss the first assigned reading, Journey to the Common Good by Walter Brueggemann.

“They began to say, ‘this is the first time we’ve ever heard the story of Solomon talked about in this way and we realize what a shallow approach we’ve taken, that the church has taken [regarding money],’” he said.

Mindful finance

Engaging in a new way of thinking about money prompted Darell Harrington to enroll in the course. Before going into full-time ministry, he worked in finance, first at Wells Fargo and then at Hope Credit Union in Memphis.

He felt that the class provided the Biblical foundation for understanding “what a good financial life is all about.”

Prior to attending the class, he said he had never really thought about socially conscious investing.

“I’ve invested in a number of companies without a second thought of the good that they do, or the lack thereof,” he said.

As the senior pastor of New Sardis Baptist Church, the course made him more mindful about “doing business with companies, and with individuals, who want to see the world as a better place,” he said.

His congregation has wanted to start a clean energy initiative for some time. His participation in the course enabled him to connect with a company that can help his church take that next step. He also decided to reignite a financial literacy program at his church. In the past, the church offered workshops on everything from credit management to budgeting, with the goal of helping members become financially equipped. But what was missing, he said, was the spiritual perspective. The class provided that.

A spiritual and financial responsibility

Harrington isn’t the only student who walked away with new insight. In an anonymous survey, 70 percent of students who completed the course said they experienced a great deal of change in their understanding or appreciation of the scriptural and theological framework surrounding money.

“I have realized that my financial responsibility is not only to my family and church, but it is a spiritual responsibility as well,” one student noted. “I’ve gained a greater appreciation for the fact that I am a financial manager, and the effectiveness, or the lack thereof, is a testimony in itself.”

While more than half of students said they have observed changes in their lay, pastoral or prophetic roles, even more students noted the profound personal impact the course had on their lives. Some students shared that they have already sought out financial advisers to help them manage debt and budgeting.

“Almost everyone started the class with the notion that money is simply a tool that we either use for good or for bad,” Vaughan said. By the end of the class, everyone had to come to recognize the power, and even spiritual force, that money has in their lives.

For Gunn, the hardest part of the class was the end.

“I just remember every time we met, I didn’t want to leave,” Gunn said. “So many of our students have been saying this should be mandatory at all seminaries.”

It’s something Faith and Money Network would like to see become a reality at seminaries across the country.

Mike Little said Faith and Money Network is eager to meet seminaries where they are, helping them teach seminarians how to build more just and generous communities beyond budgets and finance committees.

“People are thinking about money all the time, but they don’t often have a safe place to talk about it,” he said.

While the curriculum may change according to the needs of the seminary, Little said the mission of the course will remain the same: Equip pastors to address money scripturally so it becomes a natural and normal part of congregational life.

Christina Colón | June 15, 2020

Christina Colón is a writer, editor and digital strategist. Her work has appeared in Sojourners and Global Press Journal.